A phishing campaign that targeted HMRC in recent weeks has left a shocking trail that has raised public concerns about the security of digital identities in addition to exposing a weak aspect of government infrastructure. An estimated £47 million was stolen from about 100,000 PAYE taxpayer accounts that were compromised by criminals posing as authorized users. Surprisingly, the hack was based on common deception rather than a Hollywood-style scheme involving dark web masterminds and encrypted malware.

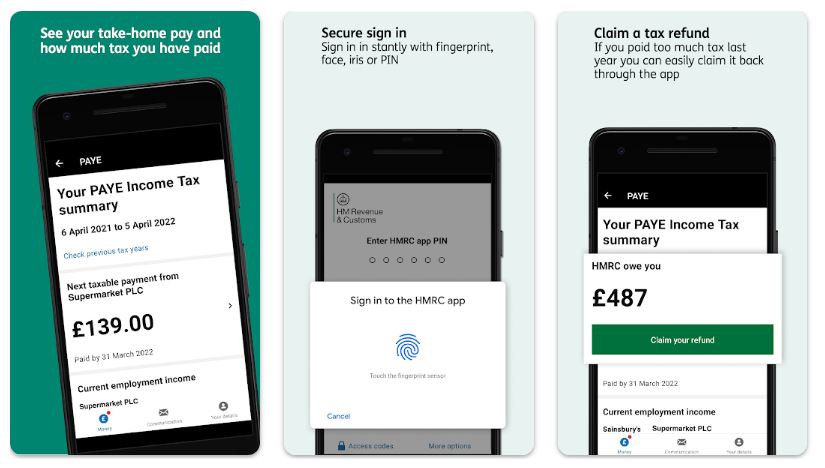

Fraudsters obtained login credentials from gullible people by impersonating HMRC in emails and texts. They used these credentials to open or access online tax accounts, make fraudulent claims, and transfer money into accounts under their control. The strategy was incredibly successful because it capitalized on routine rather than being complicated. “You’re due a tax refund” was an apparently routine message that turned into a trap that brought in millions of dollars.

Key Information on the HMRC Phishing Attack

| Detail | Information |

|---|---|

| Target Entity | HMRC (His Majesty’s Revenue and Customs) |

| Attack Method | Phishing – via stolen credentials from fake emails and messages |

| Affected Individuals | Around 100,000 PAYE taxpayers |

| Estimated Financial Loss | £47 million lost through fraudulent tax rebate claims |

| Direct Victim of Theft | Public funds, not individual taxpayer accounts |

| HMRC Response | Lockdown of accounts, notifications sent, and system security improvements underway |

| Criminal Proceedings | Arrests made, investigation ongoing with national and international coordination |

| Criticism Faced | Delay in public disclosure and inadequate reporting to Parliament |

| Risk Advisory from HMRC | HMRC never asks for personal info via email or SMS; report suspicious messages immediately |

| Source | GOV.UK Phishing Alerts |

During a Treasury Committee hearing, HMRC’s deputy chief executive, Angela MacDonald, provided an incredibly detailed explanation. She clarified that a large number of the fraudulent accounts were owned by people who had never even created an online account with HMRC. Because of this, it was especially challenging to identify the deception early on. In essence, criminals were creating false profiles within the system and using them to collect money.

The hack has drawn immediate criticism, not only from tech specialists but also from lawmakers who were particularly irritated by the postponed announcement. It wasn’t until the attack was publicized that the Treasury Select Committee became aware of it. During a live session, Chair Dame Meg Hillier spoke to HMRC officials and called the delay in notifying Parliament “unacceptable.” Despite being straightforward, her tone betrayed a broader concern about how prepared public systems were to face contemporary cyberthreats.

Phishing techniques have evolved over the last ten years to become extremely flexible, adjusting to social media, WhatsApp messages, and mobile devices. Like other organizations, HMRC has repeatedly cautioned the public not to click on dubious links or text financial information. However, defense becomes more challenging due to the sheer volume and realism of fraudulent messages. Today’s digital impersonators are imitating government tone and formats with startling accuracy rather than using misspelled emails or cartoonish language.

HMRC maintains that no personal money was impacted. This was a theft from the public coffers, not your private bank account. However, that reassurance feels incomplete to many. Everyone bears the cost of a £47 million theft. The money that was stolen could have been used to pay for necessary services or programs in light of the growing demands on the public sector and the economy. It’s a financial setback with real societal repercussions, not just a tech problem.

HMRC has significantly enhanced its internal procedures to regain trust. As soon as the scope of the breach was known, compromised accounts were immediately locked down. Tax records were cleared of fraudulent information. All impacted users are now receiving letters reassuring them that their accounts are safe. In the upcoming spending review, the agency is also anticipated to receive an investment boost, recognizing the urgent need for system upgrades.

The CEO of HMRC, John-Paul Marks, stressed that this was not a traditional cyberattack. Neither malware nor direct infiltration was present. In order to game the system, criminal organizations working outside of HMRC collected information from prior breaches or accounts with inadequate security elsewhere. This subtlety is significant because it moves the discussion in the direction of greater digital responsibility.

Similar types of digital impersonation have been experienced by public figures and celebrities. Impersonation has become a strategic tool for organized crime, as evidenced by high-profile banking scams involving professional athletes and phony charity solicitations that use celebrity likenesses. Another layer is added by this HMRC incident, which demonstrates that when identity verification does not adapt to contemporary threats, even strictly regulated systems can be tricked.

HMRC has started a comprehensive investigation by working strategically with law enforcement, both domestically and abroad. Arrests have already been made, and as the data trail develops, more actions are anticipated. Investigators are mapping the locations where the money was diverted and identifying digital fingerprints left by the criminals by using forensic analytics.

The ramifications are extremely personal for small business owners or early-stage taxpayers. Many people only communicate with HMRC digitally for updates, payments, and submissions. Compliance becomes more difficult if confidence in that channel declines. Individuals start questioning genuine messages, putting off taking action, and possibly facing consequences for no fault of their own.

Calls for a uniform digital ID system across UK services have increased as a result of this incident. A single, verifiable ID, according to supporters, would simplify authentication and drastically lower the risk of impersonation. Critics warn of possible implications for surveillance. Digital security can no longer be a line item hidden in budget documents or an afterthought, but the urgency is still evident.

HMRC’s advice is still crucial for regular users: never click on unsolicited links, report suspicious messages right away, and be cautious when it comes to email addresses and communication language. You can report suspicious emails to phishing@hmrc.gov.uk and suspicious texts to 60599. It’s straightforward but incredibly powerful.

HMRC has a way forward by incorporating more robust identity verification techniques and stepping up public awareness initiatives. Despite the financial pain, this breach presents a chance—a turning point where the public and private sectors can work together to restore digital trust in vital services.